What is better IP or LLC: 5 categories to compare

Which is better: individual entrepreneur or LLC - comparison of two forms of entrepreneurial activity in 5 categories.

In the Russian Federation, and in other countries, before starting a career as a businessman, you must officially register your business.

When it comes to the need to undergo this procedure for the first time, the question arises: which is better - individual entrepreneur or LLC?

After all, the number of documents that will have to be collected for registration, tax deductions, bookkeeping and many other related issues depends on this.

To make a choice, let's compare LLC and OP in 5 main categories.

Registration of individual entrepreneurs and LLC

Before disassembling all the subtleties in detail, consider a general list of differences between LLC and individual entrepreneur.

| Ltd | SP |

|---|---|

| May have multiple owners | Has only one founder |

| To open an LLC, you need to collect several times more securities than for an individual entrepreneur. | To register, you need to prepare three documents: a receipt confirming the payment of the state duty, an application for registering a business, a passport. |

| State duty - 4,000 rubles. | State duty - 800 rubles. |

| Requires an authorized capital (from 10,000 rubles) | No authorized capital required |

| The registration period is 5 days |

Where is the best place to register LLC and individual entrepreneur?

In addition to the difference on the points listed above, there are differences even in the place of submission of documents.

Place of registration of individual entrepreneur

It occurs exclusively at the place of registration of the entrepreneur.

You can find out the necessary data on the website of the Federal Tax Service: https://service.nalog.ru/addrno.do

If you do not have the opportunity to come in person, you can submit documents remotely: https://www.nalog.ru/rn77/service/gosreg_eldocs

And here it will be possible to make the appropriate deductions already at the place of actual residence.

Place of registration LLC

Regarding the place of registration of the LLC, other rules apply, which can also be found on the website of the tax inspectorate: https://www.nalog.ru/rn77/yul/interest/reg_yl/register

There are three ways to solve a targeted problem:

Premises for rent.

For this, a premise in the city center or in places of good transport interchange is best suited, so that it is more convenient for clients to get to and find an office.

You can, of course, buy an office space. But, as practice shows, novice businessmen cannot afford such a luxury.

Ask for help from specialized companies.

This method of obtaining a legal address will be much cheaper than buying or renting it.

But the choice of an intermediary company must be approached with all responsibility, because sometimes the addresses they sell are on the black list of the Federal Tax Service.

In this case, it will not work, since the application will be rejected.

It is best to turn to trusted companies for help, such can be business incubators.

Use home address.

The law does not prohibit doing this, but this step will "tie" to the place of registration.

That is, to indicate in all documents Ryazan as the place of registration, but it is impossible to work in Moscow.

What is better IP or LLC: comparing "areas of responsibility"

Among the facts, than an LLC is better than an individual entrepreneur, in the first place, they call the lack of responsibility their own property.

What does this mean?

An individual entrepreneur, if suddenly a business goes bankrupt, is liable with the existing real estate, car, dacha, that is, with all the personal property acquired.

That is, becoming an individual entrepreneur, you designate all your own property as the material capital of the company;

But the LLC is responsible only for the funds of the enterprise, which were initially invested in the business.

This financial reserve is called the Share Capital.

Its value may be different, but not less than 10 thousand rubles.

But not everything is as simple as it seems at first glance.

When registering an LLC, the owners automatically take over not only legal responsibility, but also physical.

When it comes to this issue, they often imply only legal responsibility - designated by law and indicated above.

But if the LLC for some reason did not cope with the payment of the loan to the bank or owes its partners, and the authorized capital did not allow to cover the debt, then the obligations for payments fall on the founders of the company.

So do not expect that you can "amass" millions of dollars in debt, calmly declare yourself bankrupt and go on indefinite leave.

Are there any exceptions to the rule?

Even with huge debts, according to the legislation of the Russian Federation, there is a list of possessions that are not subject to seizure from individual entrepreneurs.

For example, it can be a single apartment or land area.

You can view all the options on the website http://ogpkrf.ru/st446

What is better than an LLC or an individual entrepreneur: comparing taxation and deductions

The tax payment system is one of the key aspects of doing business, therefore, novice entrepreneurs are interested in the question of which form of deductions is the most profitable, and is there a difference in tax deductions for LLCs and individual entrepreneurs.

Who pays and how much?

Regardless of how much the individual entrepreneur made a profit, the founder must annually deduct contributions to the Russian Pension Fund.

For 2017, this amount is 27,900 rubles.

Such an established payment is considered a disadvantage of individual entrepreneurship in front of an LLC (because the latter can “stand by” without any deductions, free of charge).

But if you consider that this is a one-time amount per year, then the minus is small.

But all the money earned by the individual entrepreneur can safely spend at his own discretion, without making additional deductions.

An LLC does not have such a privilege - all movements of money are displayed in accounting reports, and from each profit 13% is sent to the state treasury.

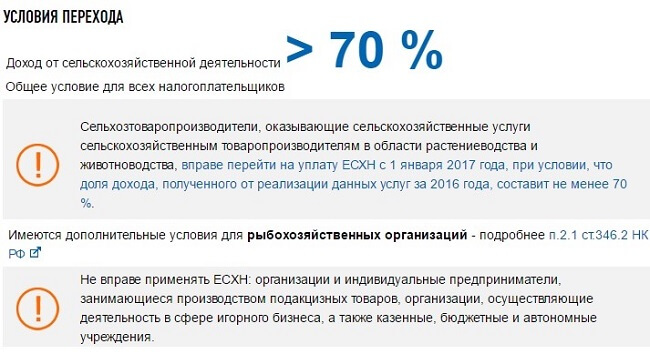

5 tax systems in the Russian Federation

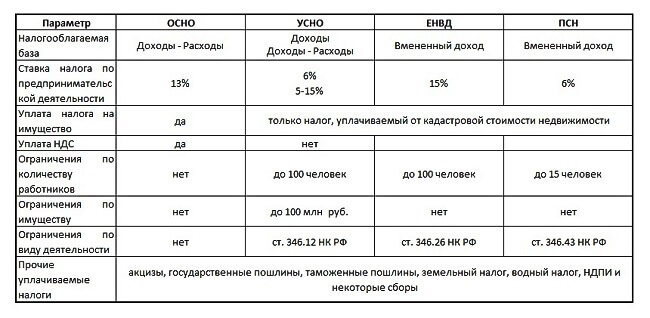

All 5 existing types of taxation are equally "efficient" for both individual entrepreneurs and LLC (except for PSN).

This list includes:

As you understand, when choosing which is better - LLC or individual entrepreneur, the tax system matters only when you need a patent option for deductions.

In other cases, the choice of the type of taxation occurs after the fact.

A nice bonus for readers is the comparative characteristics of the main 4 systems:

What is better to open - individual entrepreneur or LLC - for certain types of production?

Individual entrepreneurship, unlike LLC, does not have the right to open a business in the following areas:

- alcoholic beverages industry;

- business in the banking sector;

- pawnshops;

- manufacturing of medicines;

- investment funds.

SP does not give the right to obtain licenses. Therefore, sometimes there is no need to make a choice of what is better to open - an individual entrepreneur or an LLC. the state does not provide such an opportunity at all.

What is better to open - LLC or individual entrepreneur - to withdraw money?

The purpose of starting a business is to make money. But before the money is in the hands, it must (obviously) be withdrawn from the case.

In this case, the individual entrepreneur has a significant advantage over the LLC.

For individual entrepreneurs, as already mentioned, the money earned is in free use, and it can be easily taken from the safe or from the bank account.

But with LLC things are a little more complicated. All the money that the firm earns, even if the owner is the only one in the state, is the property of the enterprise.

How do founders of LLC withdraw money?

The output can be done in the following way:

- salary to employees;

- using dividends;

- contractual loans;

- contracts with third-party individual entrepreneurs;

- contracts with other firms.

Dividend payments- that is the only correct system of distribution of the funds earned by the company among its founders.

Dividends are paid to each founder after all tax deductions and deduction of various fees, that is, this is the company's net income.

The distribution of earnings of the Limited Liability Company can be made quarterly, once every six months, at the end of the year.

The periodicity of payments at each enterprise is individual, but most of the LLCs make them at the end of the year.

Accounting for individual entrepreneurs and LLC

Accounting for individual entrepreneurs

An individual enterprise has the right to keep records in accordance with the following points:

- if you open a business as an individual entrepreneur, then the founder will be able to maintain a more simplified form of accounting than for an LLC;

- you do not need to include an employee such as an accountant on the staff;

- the use of the patent system is possible;

- equipment is not subject to reporting;

- does not require payment of property tax;

- you can do without a cash register;

- has a fixed contribution to the PF;

- the debts of the past year are not covered by the profit of the current year.

Accounting in the form of LLC

LLC must keep records in accordance with the following points:

- opening a business under the registration of an LLC means maintaining detailed accounting reports for the tax service;

- must have an accountant in the staff;

- is unable to resort to the patent system;

- it is obligatory to have a cash register and full control over the money in it;

- the equipment is registered in the authorized capital;

- property tax must be paid;

- last year's debts are covered by the income of the coming year.

What is the main difference between an individual entrepreneur and an LLC?

A representative of a consulting company helps to deal with the nuances:

The article discussed in detail the issue what is better to open an individual entrepreneur or LLC.

In fact, it makes no sense to compare these two forms of registration, because they are completely different.

But it should be emphasized that an individual entrepreneur is more suitable for doing a small business, but an LLC is intended for large-scale production.

It only remains to add that LLC is more difficult to register and conduct business, but more solid and gives special privileges.

Helpful article? Don't miss new ones!

Enter your e-mail and receive new articles by mail