How to find out / check arrears for taxes on the INN (for an individual)?

If you have a need to check the tax arrears on the TIN, then this can be done in several ways, in particular to conduct online debt checks before tax. In most cases, the citizen can easily receive information about their tax debts with the help of the Federal Tax Service of the Inn, but in some situations tax debt data can be considered only after receiving special access to the tax inspectorate at the place of registration.

In this article we will introduce you to all available methods for obtaining and checking tax arrears.

Is it possible to learn about the tax and tax debt?

A natural person who pays taxes, from time to time faces the need to learn information on existing tax debts having at the disposal of its INN, such information may relate to:

- Overdue debt on tax payments.

- Taxes that have been paid (in order to avoid re-payment).

- The debts that were appointed to recover the tax inspection, but were not paid in fact.

- Tax payments for which the payment period has not yet come (was not overdue).

This information can be obtained online, having an Internet access, or in a tax inspection located in your area. Information about the various types of tax debts that can be found in TRN are posted on a number of government Internet resources that we will tell about this publication.

As a rule, tax arrears can be found and check in the following information: the full name and date of the birth of the taxpayer; INN (taxpayer identification number); Snaps An individual number from the certificate of compulsory pension insurance. In some cases, the registration and receipt of the EDS (electronic digital signature) will be required, for example, to authorize on the State Service portal to access a database containing tax information.

What sites can you check the tax debts on the TIN?

As we have already mentioned, there are a number of public websites and portals, where you can check the debts on TIN and FULL Taxes, we will now focus on the main Internet resources containing tax information and allow you to access online access.

1. Website FNS - Check the Tax Debt on Inn

If you need to look at Taxes online by Inn, then the first resource you should visit http://www.nalog.ru/ is the site of the Federal Tax Service of Russia. On it, go to your "personal account of the taxpayer for individuals." To get into it, you need to go to the main page and take advantage of the "Pay Tax" menu.

You should know that you can enter your personal account using a password, which can be obtained in the territorial separation of the tax service. The taxpayer must write a statement, on the basis of which the FTS registers it on its website and gives a registration card - it contains information on the procedure for using the personal account, as well as a password to access the tax database. Login to enter the personal account is the Inn citizen. This method makes it possible to learn the Inn Debt.

After the user is registered on the site, in three days it will receive access to his personal account. In addition, the initially issued temporary access password should be changed within 30 days, otherwise you will have to re-receive a password in the tax inspection.

If you have lost (or you simply do not have it) a certificate of registration in the tax, then you should not worry about, since you have the opportunity to know your inn on the site Nalog.ru. To verify which Inn is assigned to a particular physical person, the details of passports and the name will need. For the Inn entrepreneur, there will be enough full name and region where he lives.

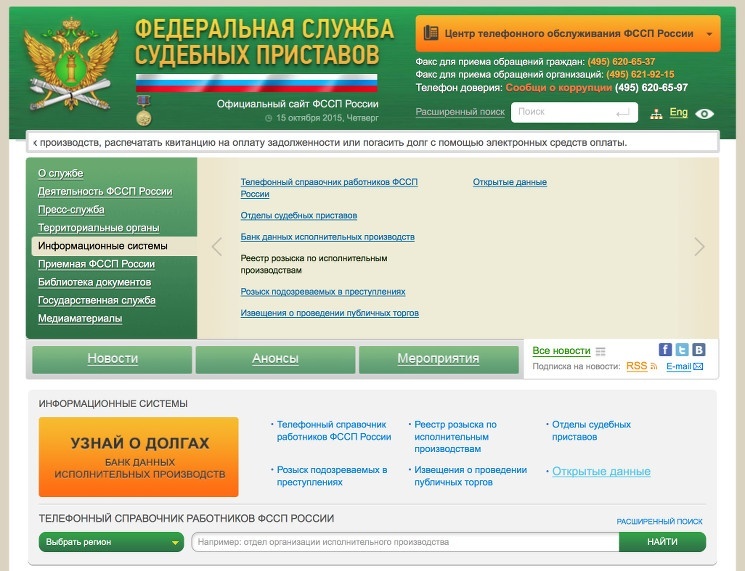

2. The site of FSSP - check out overdue tax debt

Information on debt, which was overdue, can be obtained on the official website of the FSSP (federal bailiff service).

Come on the official website of the FSSP http://fssprus.ru/ - find the "Search Register for Executive Production" tab (see Screen Screenshot in Illustration), after which you will have access to the necessary information. You do not need to register on this site, and information can be obtained without the INN. It will only be necessary to enter the name and surname of the debtor in the search column and choose the required region from the list. If you need to get more accurate data, then you should specify the date of birth and full name.

3. Unified website of public services - learn tax debts online

Information on tax debts can be obtained on one resource - a single portal of public services. We go to the site gosuslugi.ru, we find the tab "Tax Debt of Individuals" on the main page and click on it.

To obtain data on the ENGU portal (Single Portal of Public Services), you must register. To pass this procedure, you should specify your SNILS number and the following personal data:

- Full name;

- date and place of birth;

- place of registration (at the place of residence and at the place of stay;

- home phone;

- email.

The registration will be activated by the SMS number or by the phone number using SMS (Depending on the authorization method you choose, one or another set of functions will be available, so for example, an EDS key you get access to all tools and functions of a single portal of the State Service).

How to find out how to repay the amount of tax online on TIN?

If you have a need to find out the amount of taxes, which did not come (or not expired) the payment period, then this is how we have already considered above can be done on the FTS website, going to the "Personal Account of the Taxpayer". Required information is in the tab "Accrued".

If you have paid the tax in advance for which the payment period has not yet come, then information about it will be in the column "Overpayment / Debt" and until the amount of payment expires, the amount will be taken into account as overpayment. When the term for payment is suitable for an end, the amount will be moved to the column "payment".

Also, the information about which we told above can be obtained on the portal of the State Service.

How to learn overdue tax arrears on TIN?

In the case where the taxpayer missed the payment period of tax, and it needs to know the size of the tax debt, then it is possible to obtain the necessary information on the FTS website by turning to the personal account. Similar information can be obtained on the public services website. The debt will be taken into account as "debt" and get information about it is available with the help of "Overpayment / Debt" graph.

In the case where the taxpayer voluntarily pays debts, the tax inspectorate will accumulate them in court, and for this, the proceeding mechanism will be used. This scheme is a simplified procedure for legal proceedings, for which the presence of the debtor's taxpayer is not required. After that, the judicial order will be transferred to the federal bailiff service.

On the FSSP website, you can find information about the so-called executive proceedings, which are cases for the recovery of debt on taxes in a compulsory basis. Bailiffs are engaged in this procedure. Extracting data contains the place of residence of the debtor, the full name, judicial act (the basis for the recovery of debt) and the amount of debt.

How to check the transport tax debt tax on real estate tax?

On the FTS website there are no differences between local and federal taxes. After some time (most often it is several days), when information about the object of taxation appears in the inspection, in the "personal account" of the taxpayer in relation to this object (movable or immovable property) you can find the arrears of an individual at the Inn number. The amount of tax can be checked when the tax of the tax on this object comes.

If you need to find out property, transport taxes or the amount of real estate tax debt, it is enough to click on the relevant object - real estate, car, land plot.

In order to quickly check the information on the tax on the car (transport tax) on the public services portal, you can use the "Add Vehicle" function. What should I enter the name, series and number of the certificate of registration of the vehicle and the state number of the car in the appropriate fields.

Information about NDFL is submitted to a separate Count, which represents information on taxes paid at the place of work (2-NDFL), as well as on the 3-NDFL declaration.