Tax debt on the INN of individual

Some taxpayers know do not know about their own debt to the budget - they did not receive the receipts and requirements or for some other reasons. However, this state of affairs leads to fines from the IFSN and the formation of penalties. To avoid such things, from time to time you need to track your own debt on the Inn.

How to do it? On special resources, some of which work in free informing mode, whereas others will need access from the tax inspection.

To begin with, we will understand: how to learn about tax debt, which is called "first-hand", that is, in the local department of the IFTS or on the official website of the service.

Table of contents:Debt on the payment of taxes of individuals

What is important to himself to see the taxpayer, going to the official tax Internet resource? A few moments:

- information about the tax payments already conducted (in order to avoid re-payment);

- current taxes, as well as those that are still to be paid;

- existing personal tax debt;

- debt over proceedings (accrued penalties).

In order for the local tax inspection branch to provide the taxpayer access to the site, you should personally contact the IFX with:

- passport;

- Reduss;

- and testimony TIN

The inspector must also call their own full name and full birth date, write a corresponding statement. After that, the citizen will receive a personal pair of a login password, which will allow him to enter the official tax resource every time without problems.

How to find out tax debt

Despite the promises of all sorts of sites, on requests like "View Debt on the Inn", it is better not to look for anything. Information posted on dubious resources is far from reliable. Moreover, from taxpayers there will certainly require to introduce personal data, and this is very unsafe.

The correct solution for viewing personal debt on taxes and fees is the official portal of FTS, access to which is on a personal request (will have to write a statement) any citizen can receive in the local tax department.

How to find out arrears for taxes on the Inn on the FTS website

Personal Cabinet Taxpayer At the resource of the Federal Tax Service - here is a place where, authorized, you can always get information about your own tax liabilities in full.

Access to the personal account (admissive pair of login-password) is needed in the IFTS at the place of residence, providing a statement and package of documents. After turning the taxpayer, a personal map and the rules for using the cabinet on the site are issued. The password will be temporary (it acts only a month and when registering it is better to immediately change to his own, which will be fixed as a permanent), and the login will become the Inn citizen. Thus, personal tax debt to learn on the Inn will not work.

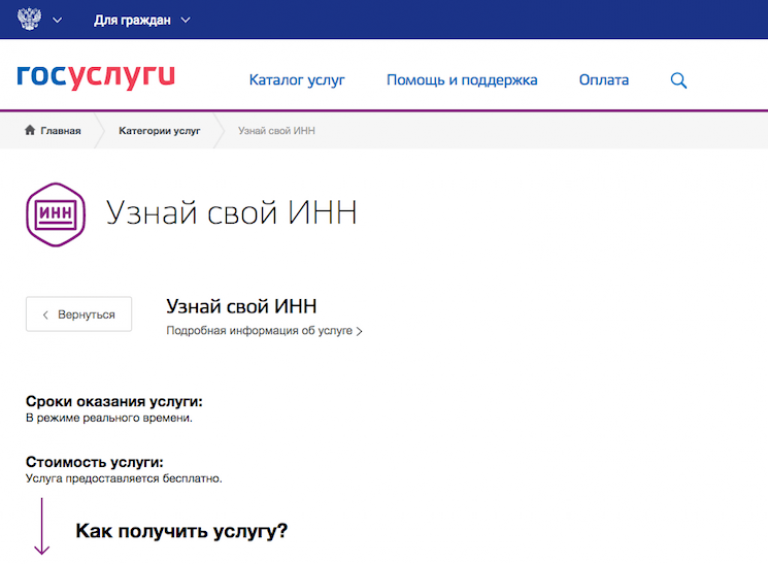

How to be the one who is still not aware of its own individual taxpayer number (INN) or has the corresponding certificate? To help such citizens, it is possible to recommend the official portal of the State Service, where in a special section it is easy to learn everything and even order a duplicate of the lost document.

You only need to register (this can be done via the Internet, without contacting anywhere) on the resource and gently enter into a special form requested data / information.

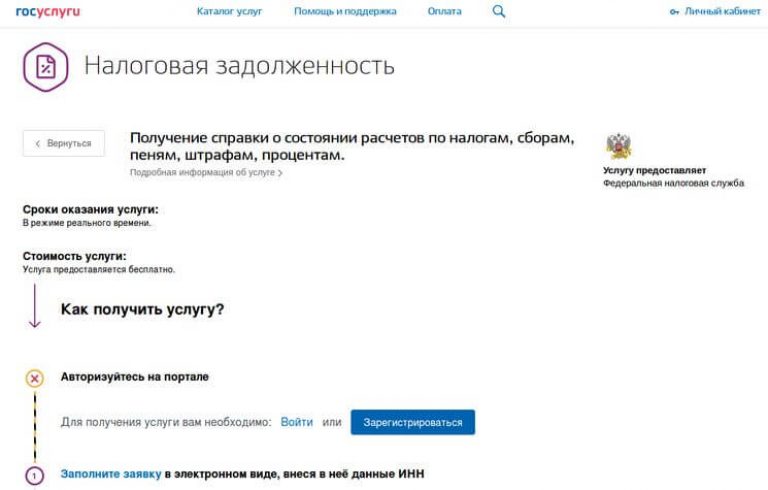

Tax debts on the public service website

This is another reliable source from which you can learn your own debt before the tax / fees. The public service portal is clearly and without delay issues all the necessary information. For example, on transport, property, land and other taxes, "listed" for the user. And he barely goes to the portal by introducing his login password (enshrined at registration), as it will be visible (right) all tax information regarding him personally.

But initially (immediately after registration) will have to go, of course, more complicated. Choose from the services offered by the service life "Tax debt of individuals" and go through it.

And from the moment the personal data of the taxpayer on the resource is confirmed (this can be done in different ways), information on accrued taxes existing debts, penalties and penalties will be apparent for an authorized user immediately (in a special field on the right).

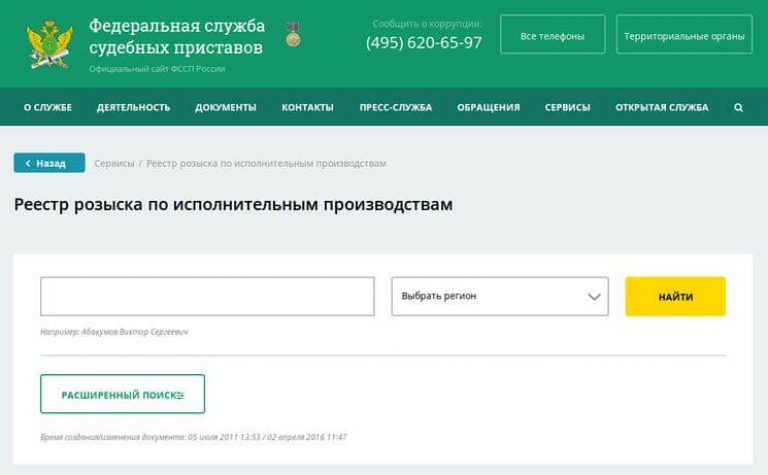

Find out tax arrears on the site of the FSSP RF

On the existing debt (if it is expanded so much that the IFNS had to go to the campaign bodies) a citizen can always find out on the website of the federal bailiff service (FSSP), in the section "Register of the Search for Executive Production".

There is no need to introduce the INN of the taxpayer, quite a name, the date of birth (in order to seal the same names with the same IU) and the region of residence.

This registry is especially important to check (from time to time) to people who often travel abroad for business or gathering on vacation. Since the srsp to the list of debtors probably means both a ban on the departure / departure of the debtor beyond the Russian Federation. And if you put such things on samonek, it is possible to be informed too late (for example, at the airport, immediately before the flight). And it means to lose your holiday, disrupt the negotiations or signing important agreements, losing funds, face other troubles.

Non-phase tax debt on TIN and the amount of tax

On the website of the FTS www.nalog.ru (in the Personal Account, after receiving official access and registration), you can always get information about accrued taxes, the payment period for which has not yet expired. To do this, just follow the link "Accrued".

If the period of payment of some tax has not yet come, it can be paid in advance. And you can find such information in the "Overpayment / Debt" section. Since any payment for taxes and fees, which has not yet approached, will be listed "overpayment". And when the time is suitable, the payment made by an advance payment will automatically go into the section "Completed".

The same data are displayed on the website of the State Service.

Check overdue tax debt on TIN

If the payment for tax credits has never received, debt information will remain in the relevant debt section. And on the FNS website, and on the Public Services portal is exactly as long as payment is not credited to the budget.

It should also be borne in mind that the information is not published immediately. And while money will be credited, and the debt is removed, it can pass from the week to four.

Tax debt of individuals on the INN on the site of the FSSP

How does the tax inspection accumulates debts with non-payers? Through the court, of course. By receiving the appropriate court order. And to make such a solution, the courts do not need the presence and explanations of the debtor at all. However, he remains the right to cancel such an order (if he considers taxes paid after or illegally accrued), and then litigation (on the initiative of the plaintiff, that is, the tax authority) will be carried out in the manner prescribed by law.

How does the tax inspection accumulates debts with non-payers? Through the court, of course. By receiving the appropriate court order. And to make such a solution, the courts do not need the presence and explanations of the debtor at all. However, he remains the right to cancel such an order (if he considers taxes paid after or illegally accrued), and then litigation (on the initiative of the plaintiff, that is, the tax authority) will be carried out in the manner prescribed by law.

If the submitted judicial order was not canceled within the prescribed period, he was descended by the bailiffs for execution. There will be a corresponding enforcement proceedings (if the debtor did not fulfill the obligations to voluntarily) on forced recovery, and the debtor's data and the amount of his debt are recorded in the Register on the FSSP website.

How to learn debts on the tax of an individual on the Internet?

On the Internet resource of the FTS, you can always find out the debt of the taxpayer, both by federal taxes and taxes in the local budget.

As soon as information about the object of taxation becomes known to the IFSN, this service immediately sends information to the server, and it becomes available in the Personal Account of the registered user on the site. There you can see not only the fact of debt, but also a specific amount, as well as the size of the penalty.

A citizen can always find out the arrears of transport tax, property and land taxes. Debt on the resource will immediately open if you click on the link to the appropriate object.

By the way, information about the newly purchased vehicle can be added to the resource yourself. To go through the link of the same name ("Add a vehicle"), and there already make information about the state number of the vehicle, series and the number of certificate of state registration in the appropriate fields.