How to find out the tax debt. Several ordinary tips

Modern technologies and services allow people conveniently and quickly not only make purchases via the Internet, but also pay for various accounts, loans, including taxes. In this article, you will read about how to find out the tax debt with the help of public sites. In our country, the terms of payment and amounts are constantly changing, so most people are not able to keep track of all changes. However, with the help of online services, you can always track your debts. Suddenly the large amount that you should urgently pay to the relevant government agencies will no longer find you by surprise using custom letters or sudden calls. You can independently find a list of all taxes that should pay and even make the necessary amount directly via the Internet. Consider all sorts of ways in more detail. With our instructions you will learn to easily and quickly use each of them.

How to find out tax debt: all ways

To begin with, list all the resources you can find information to tax collects:

- first, all familiar portal of public services;

- personal account on the website of the Federal Tax Service;

- through a bank executive proceedings;

- third-party resources that do not require registration.

Consider each option in order.

How to find out the tax debt of individuals through civil servants

To begin with, we note that for this method you need an account on the Public Services portal. In addition, you need to enter all personal data to get a confirmed status. Consider step-by-step actions. Read more:

- go to the main page of the site https://www.gosuslugi.ru;

- click the "Register" button if you do not have an account in your account or "Log in" if you previously used the services of this portal:

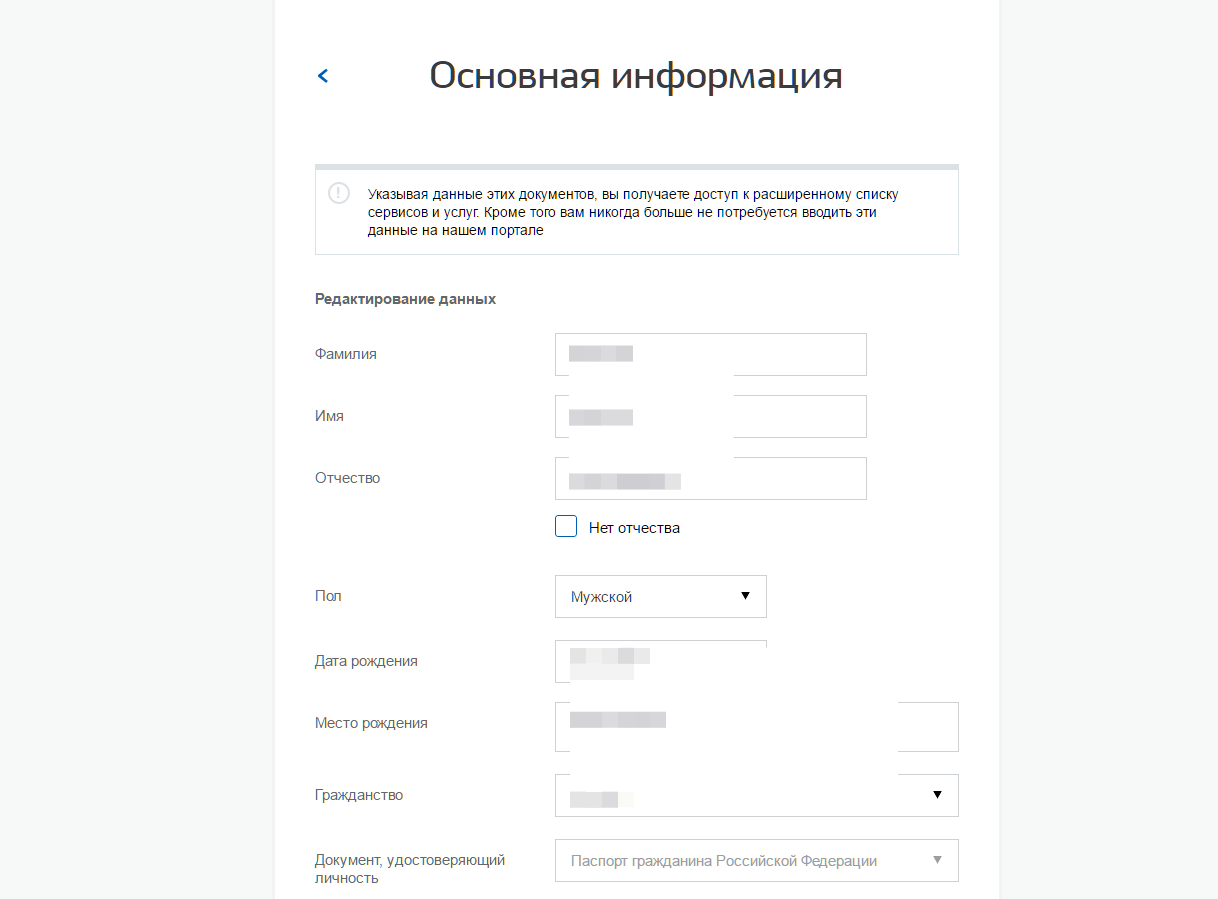

- when registering, specify the surname, name, mobile number and / or email. Next click on the "Register" button:

- on your phone or email will come SMS / letter with a reference to confirmation. Go to the public service website on it;

- now you need to fill out personal information. Enter all the necessary data and click the "Save" button at the end of the page:

- in the personal account there should be an inscription that the test was successfully conducted and you received a standard account:

The next level is obtained only with a personal visiting department with documents. However, to verify the tax debts of the standard level will be enough.

The next level is obtained only with a personal visiting department with documents. However, to verify the tax debts of the standard level will be enough.

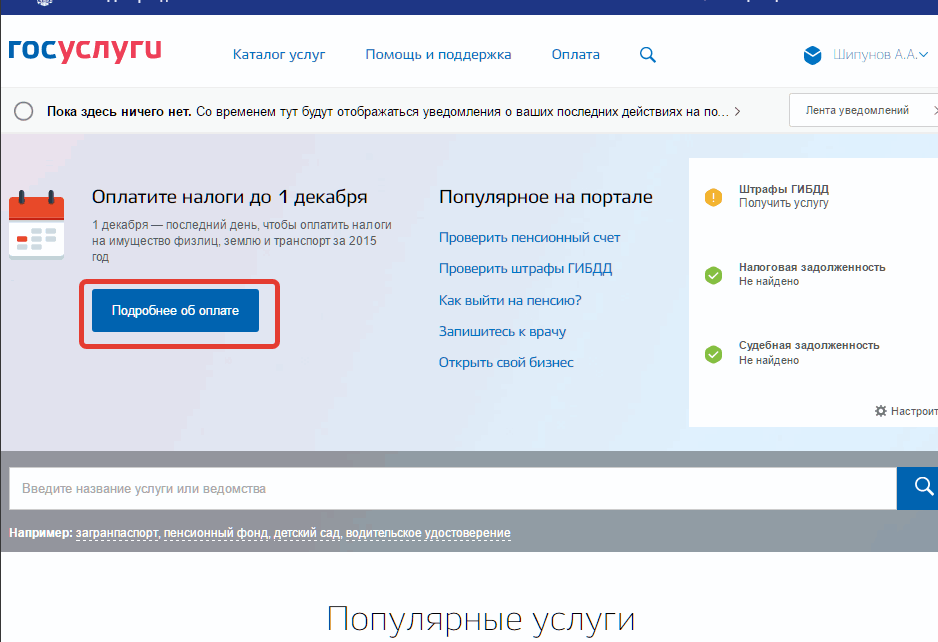

Now you can fully use all the functionality that offers a portal. Consider how to find out the tax arrears through this site:

Now back to the main page of the State Service and tell about another portal feature that you can use it. The photo marked the "Read more about payment" button:

By clicking on it, you will find yourself on the page with the instructions on how to find out the tax debt of individuals and then repay it through the site of the Federal Tax Service. Consider the main aspects to which you pay attention.

Information about taxes through the site FTS

Below in the photo contains instructions for working with the FNS site.  According to her, you must comply with the following conditions:

According to her, you must comply with the following conditions:

- your account must have the highest level (personal appearance in the service center with documents);

- without this, the conditions you will not be able to even log in to the site in the Personal Account;

- also enter your personal account using instead of login INN.

Consider step-by-step instructions for finding debts on taxes through the FNS portal:

- go to the site https://www.nalog.ru. You will automatically redirect to the server with your region;

- on the main page, you can log in to your personal account through the appropriate button (if you have all the conditions regarding the account confirmation);

- In the right link of links, you must click on the "Pay Tax" button;

- before finding out the tax debt of individuals, you must choose a payment method;

- On the right side there is a section for legal entities and IP;

- press the button "Payment of Taxes of Individuals";

- on the next page, you must enter the surname and name (required), as well as the INN;

- click the "Next" button to continue;

- now select the type of tax paid in the field, which is marked in the photo:

Press the "Next" button again;

Press the "Next" button again; - Depending on the type of tax, you need to fill out the form with the place of registration, the amount for payment;

- now you have to choose the type of payment - cash or non-cash;

- by choosing a cashless payment, you must click on your jar:

After that, you will reinforce you on the payment system website for entering data and confirm. It is worth noting that this instruction will be useful to those who already know about all their debts and obligations and just wants to pay them without leaving the house through the bank account. To access the full list of debt, you must go to your personal account:

Now you have familiarized yourself with how to find out if there are tax debts in two ways. Let us turn to the next - the site of FSSP.

Functional of the site of the Federal Bailiff Service

With this portal, you can find all the necessary information about overdue payments, since after the expiration of the deadline is transferred to the bailiffs. We will figure it out how to work with the site of FSSP:

Table with debts is simple and understandable. Through it, you can even make payment of one or another debt, directly without leaving the browser. To do this, click on the yellow button "Pay", which is located directly in the table on the amount of debt. Next, select the payment system and click on the "Pay" button. You will reinforce your payment site. We figured out how to find out if there is an arrears of taxes in an individual. In exactly the same way, you can check the debts for the IP or a legal entity if necessary.

It is worth noting that only those debt on the FSSP website appear on which executive proceedings were initiated. If you have grown to pay, but it has not yet been transmitted to FSSP, then this amount will not be displayed on the site.

Also, the FSSP portal offers users to log in in the Personal Account. Through it, you can send various applications, applications and petitions. You can log in with the help of an electronic signature and, of course, through the account of the State Service portal. Account must be fully confirmed.